Indian Minerals & Markets Forum 2019 Review

![Title pic2]()

They call it the “City of Dreams”, or Mayanagri: Mumbai, rich in history and trade, is India’s financial and business hub as well as home to Bollywood.

Last week the city was host to a major gathering of international leading lights of the industrial minerals sector attending IMFORMED’s inaugural Indian Minerals & Markets Forum 2019 at the beautiful beach side JW Marriott Mumbai Juhu.

Their key objective? To assess the reality of India’s startling economic growth in terms of industrial mineral demand and development opportunities – fact or fantasy. It was all laid bare here.

Over two days a panel of high profile industry experts delivered 20 informative and insightful presentations providing a wealth of data and much food for thought.

“Outstanding agenda and excellent choice of venue, great attention to detail in the organisation.”

Jose Martin, Global Sourcing Manager, Allied Mineral Products, USA

“Excellent and insightful sessions, good ambience, very well done.”

Sumeet Verma, Snr. General Manager, Golcha Group, India

“Good programme and well organised.”

Isabelle Florens, Purchasing Manager, Saint-Gobain SEPR, France

“Nicely organised and very informative. Mobile app very nice initiative and “Mentimeter” [live online audience poll] is very effective.”

Dr Mahesh Kulkarni, Snr. Scientist R&D, Ashapura Group, India

Proceedings were initiated by the wonderful Welcome Reception sponsored by Maharashtra Minerals Corp. Ltd, one of India’s few independent mining companies operating in industrial minerals for over 60 years.

![IMG_8922]()

![IMG_8929]()

![IMG_8941]()

![IMG_8935]()

Overview & Outlook: issues to be addressed

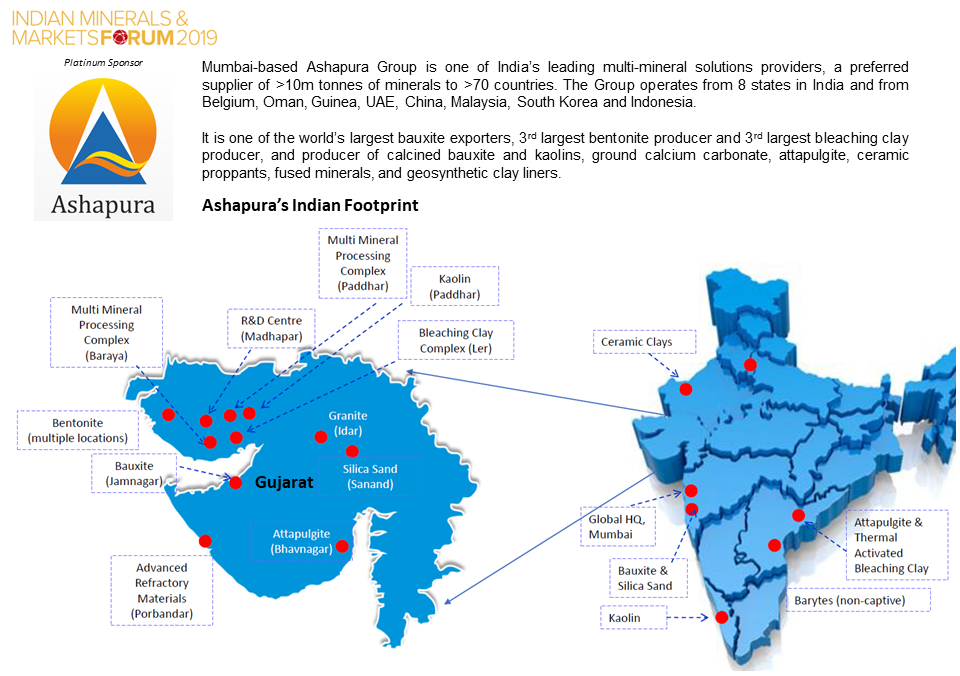

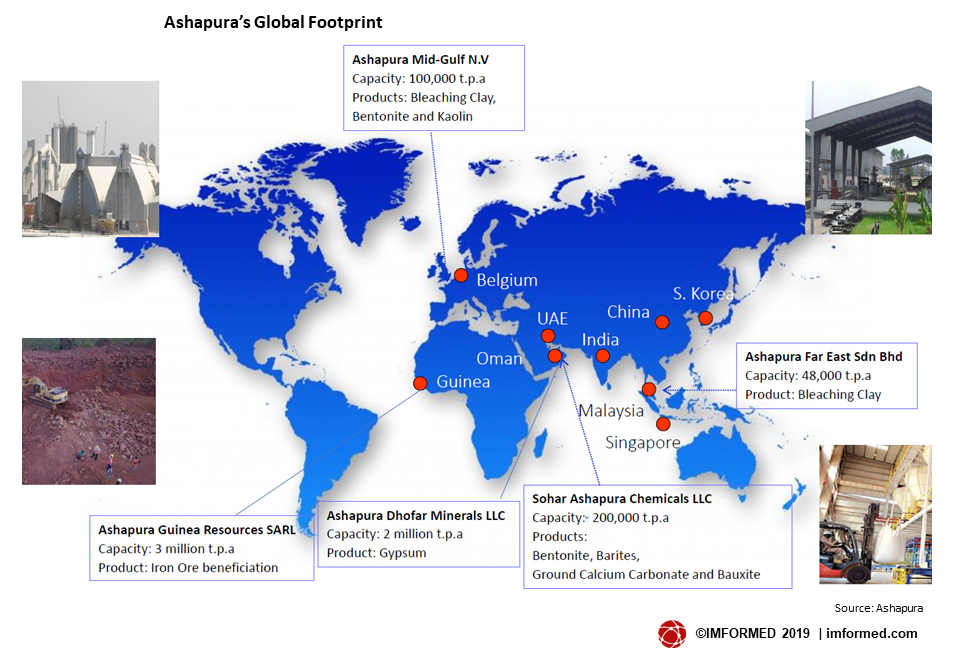

Longstanding friend to the global industrial minerals community and doyen of India’s minerals sector, Chetan Shah, Chairman, Ashapura Group, India, has been instrumental in guiding India to its respected place in the global mineral value chain, so IMFORMED was honoured to give him the floor to formally open the conference.![DSC_0889]()

In his Welcome Address, Shah offered a useful perspective on the Indian mineral industry, but did not hold back: “Our mineral excavation rate has been pitifully disproportionate to our large resource base. However, I am fairly optimistic that reforms in this sector will unlock tremendous potential and value by doing away with certain bugbears that impede its growth.”

These “bugbears” included:

- an ambiguous new mining policy

- unfounded environmental concerns

- administrative delays

- social unrest

- unclear land titles

- relatively low priority given to mining as compared to other industries

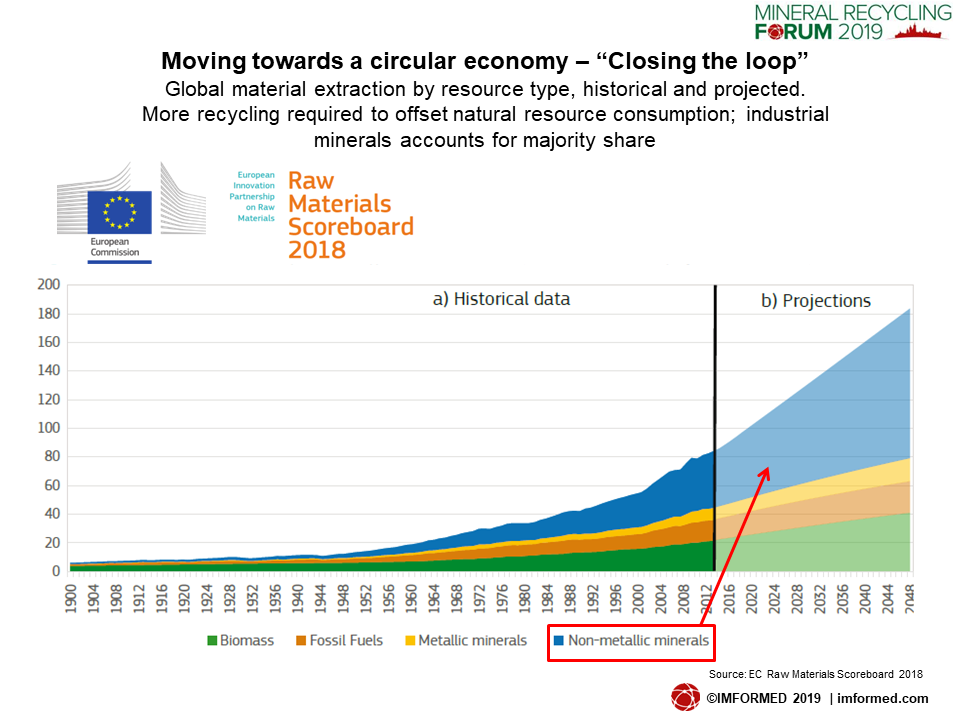

Shah then touched on the global mining outlook, acknowledging an expected rise in mineral demand but warning that environmental challenges are going to be a major roadblock for developed and nearly-developed nations, the largest consumers of minerals.

“So what is the solution? There will be a seismic change in the ‘mining geography’ of the world. Mining activities will shift from developed nations to either developing nations or to regions which are yet to join the ranks of developing countries.” said Shah.

Shah spotlighted Africa as an example, and postulated Latin America as a next target.

![Ashapura Indian footprint]()

![Ashapura Global footprint]()

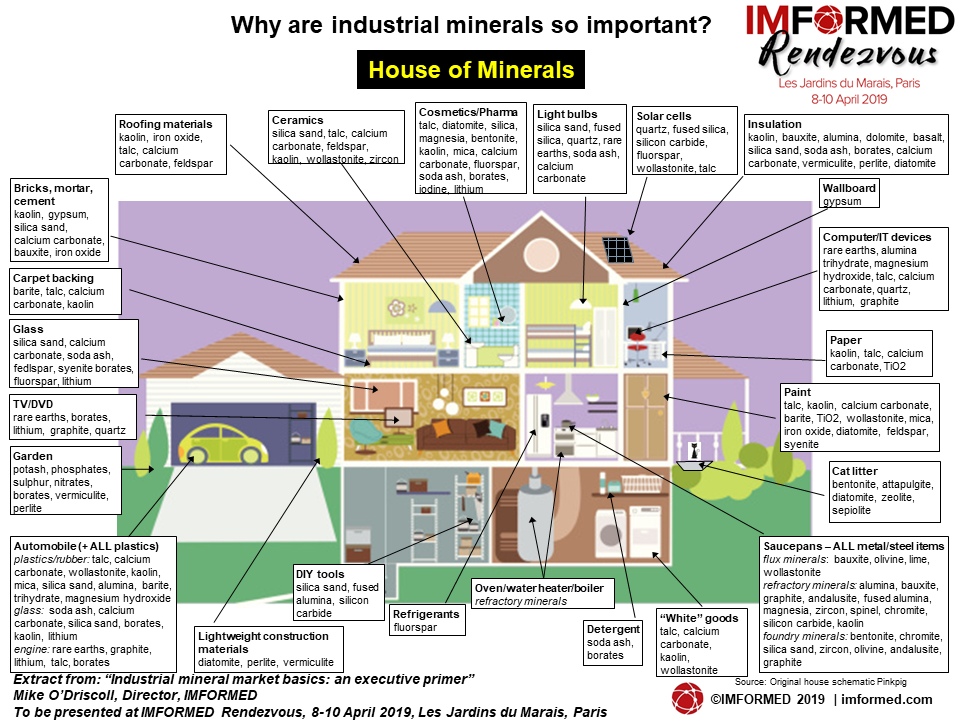

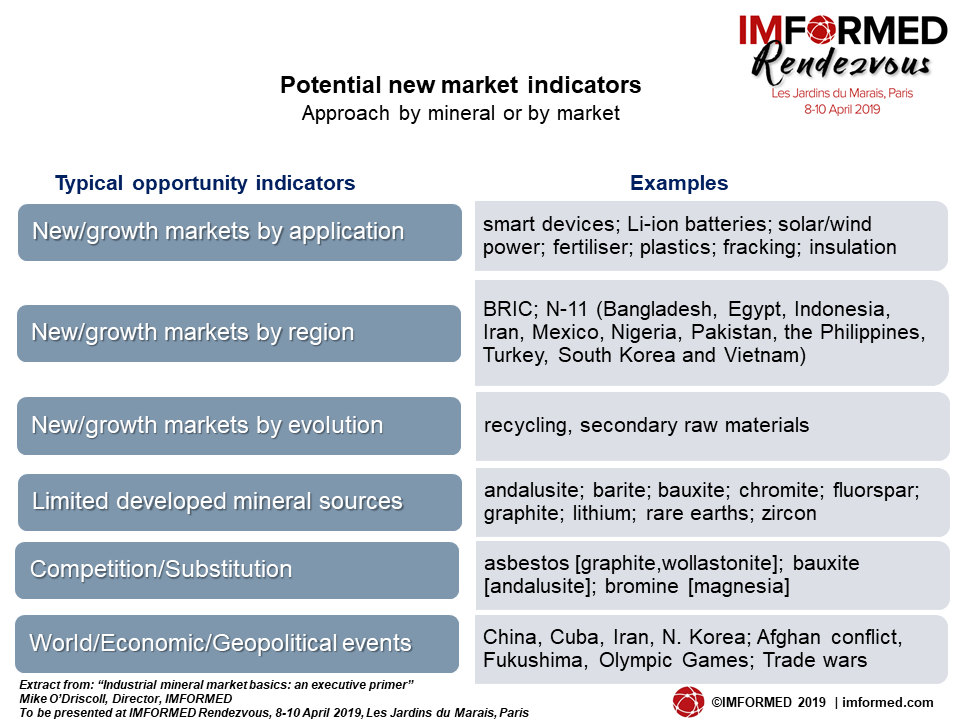

In his introduction, Mike O’Driscoll, Director, IMFORMED, UK, reminded that India has always been one of the world’s great sources and markets for industrial minerals, and is on track to be the world’s fastest growing economy.

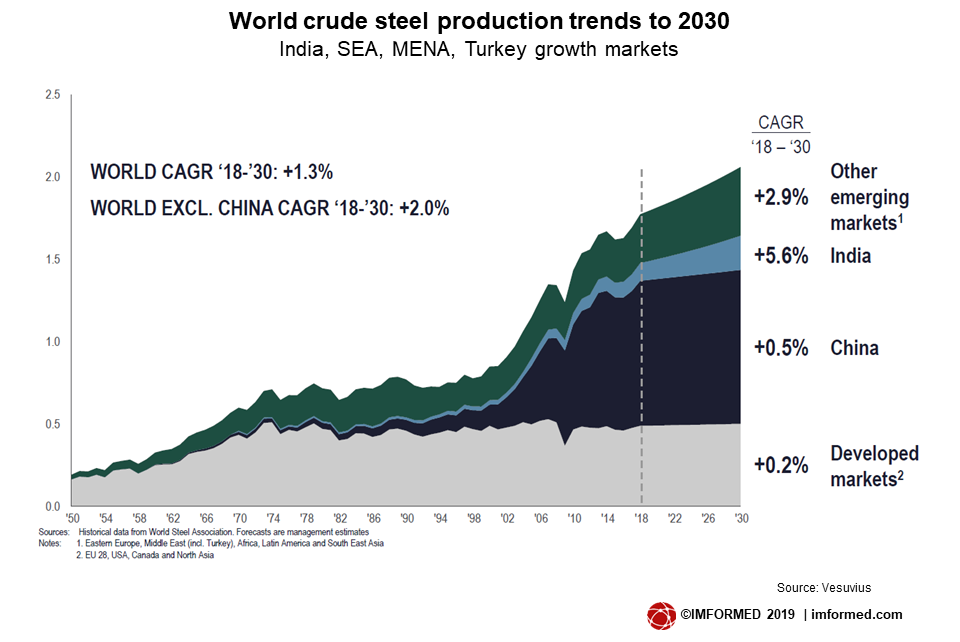

This has driven strong growth in primary mineral consuming markets, such a refractories, ceramics, filler markets, prompted emerging markets, such as Li-ion batteries, and enhanced activity by overseas subsidiaries and joint ventures in India.

In particular, raw material demands have boosted mineral resource and product development in India and surrounding countries.

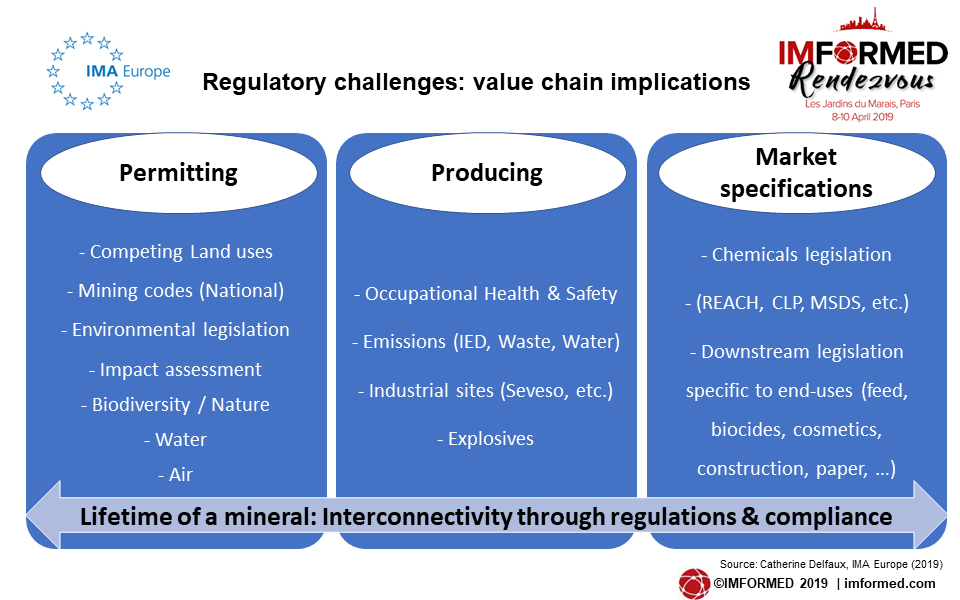

So India’s minerals industry is on the threshold of a new era with exciting growth potential in both established and emerging new mineral consuming markets. But key issues need to be addressed, including:

- Uncertainty over impacts of global recession, trade wars

- Reality of nationwide reforms and infrastructure schemes

- Logistics infrastructure challenges

- Overreliance on mineral imports

- Debatable new National Mining Policy

- Investment concerns

- Lack of domestic mineral development

- Environmental pollution

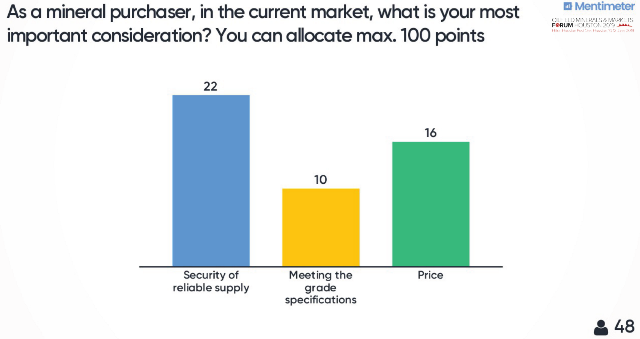

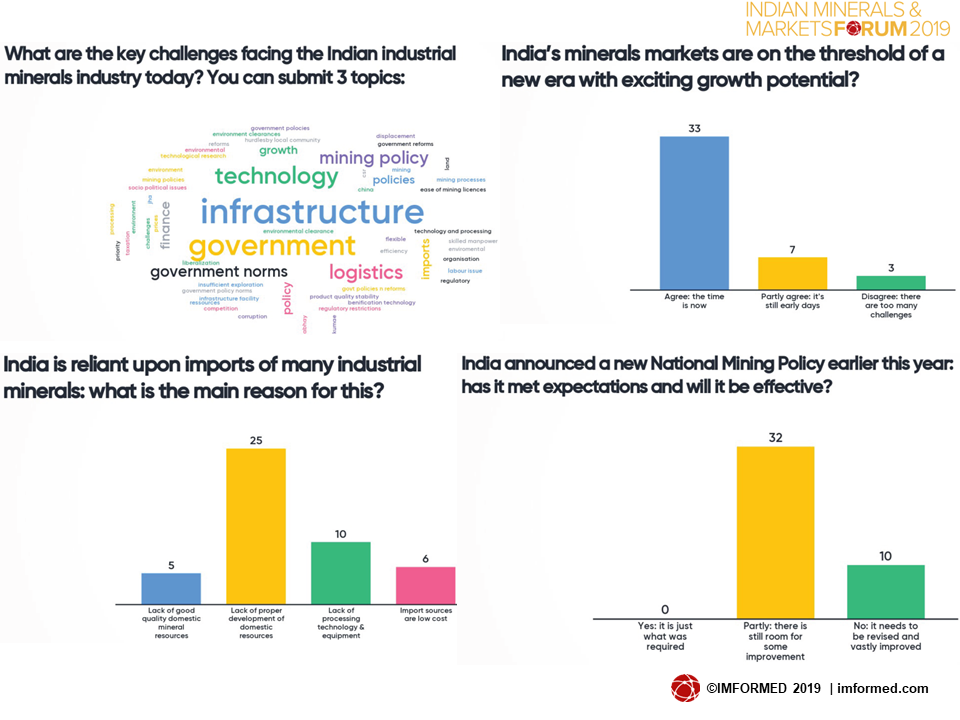

Concern over these topics was echoed in the results of the live online audience poll where “infrastructure”, “government”, “technology”, and “mining policy” dominated feedback in the word cloud of challenging issues of the day.

And while most agreed that the time is now to exploit new opportunities in India’s growth, domestic mineral development and improvement of the National Mining Policy should be high on the agenda (see results below).

![INDFOR19 mentimeter]()

Investment & trade climate: “Potential yet to be tapped”

“Mineral Project Investment & Development in India” by John Evans, Managing Director, Tractus Asia Ltd, Thailand, looked at India as the emerging key economic growth engine in Asia and projected to be the fastest growing major economy surpassing China at least until 2024.

![DSC_0923]() “India’s true mining and exploration potential is yet to be tapped, and offer opportunities for investors. New Government policies and regulations should positively impact the sector’s growth in the near future. But, India needs to adopt advanced mining practices, equipment as well as standards for safety and environment.” said Evans.

“India’s true mining and exploration potential is yet to be tapped, and offer opportunities for investors. New Government policies and regulations should positively impact the sector’s growth in the near future. But, India needs to adopt advanced mining practices, equipment as well as standards for safety and environment.” said Evans.

Evans highlighted various opportunities for investors including: equipment manufacturers & suppliers; exploration companies; technical service providers; mine developers and operators; and ancillary services providers.

He concluded with some case study examples including Neometals, an Australian company which has partnered with India’s Manikaran Power to fund a feasibility study into developing India’s first lithium refinery.

“Trading and investing in Indian industrial minerals” by Ajay Kulshreshtha, AK Minerals Consultancy Services, India, covered some historical facts, minerals, and an Indian economic review, investments, trade, and price trends in selected minerals.

Kulshreshtha highlighted that the new National Mining Policy makes efforts to harmonise taxes, levies and royalties with world benchmarks to help the private sector, as well as encouragement of mergers and acquisitions of mining entities and the creation of dedicated mineral corridors to boost private sector mining areas.![DSC_0928]()

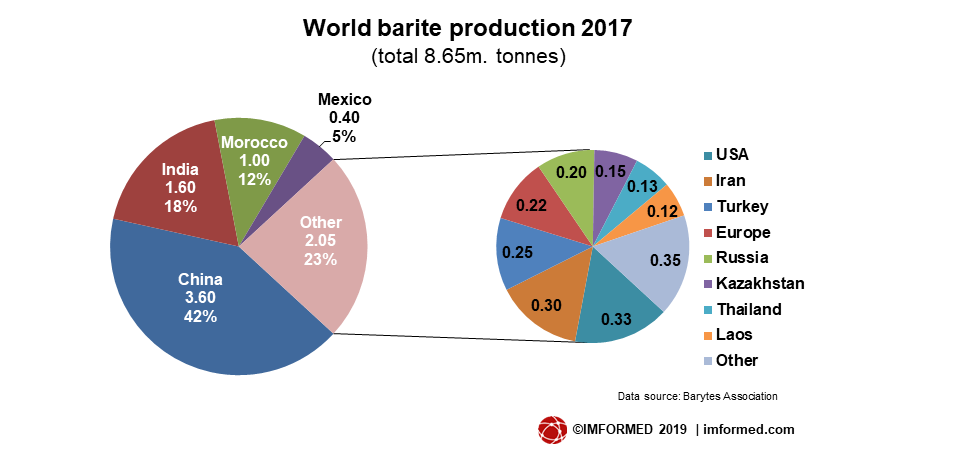

Areas of investment opportunities in mineral processing include extraction of potassium from natural nepheline syenite; drilling grade barite; and recovery of alumina from fly-ash from cement production.

Refractories: rising demand amid raw material shortage

“New refractory developments: high performance refractory aggregate” by Manan Shah, President, Orient Abrasives Ltd and Dr. Mahesh Kulkarni, Senior Scientist R&D, Ashapura Minechem Ltd, India, began with a review of Ashapura’s latest acquisition, Orient Abrasives Ltd (OAL) by Manan Shah.

Shah (below left) outlined OAL’s production capacities in calcined bauxite and chamotte (175,000 tpa combined), brown and white fused alumina, white fused mullite and fused zirconia (28,000 tpa), and castables (24,000 tpa).

With the industry in need of lower cost alternative raw materials, Ashapura has responded by launching a range of sintered brown tabular alumina (BTA) grades.

![DSC_0934]()

![DSC_0936]()

Kulkarni (above right) introduced BTA and its four grades of 87%, 89%, 91%, and 95% Al2O3 content, imparting properties of high refractoriness, hardness, thermal shock, corrosion and abrasion resistance, and claiming to outperform fused products in castable applications.

“Refractory raw materials supply & demand in India” by Hakimuddin Ali, former Chairman Imerys India & former Chairman IRMA, India, was a detailed and passionate review of India’s refractory mineral resources, their domestic demand and reserve limitations, and overreliance on imports.

![DSC_0941]() “The refractory industry is crushed between the two big rollers of suppliers and end users.” said Ali.

“The refractory industry is crushed between the two big rollers of suppliers and end users.” said Ali.

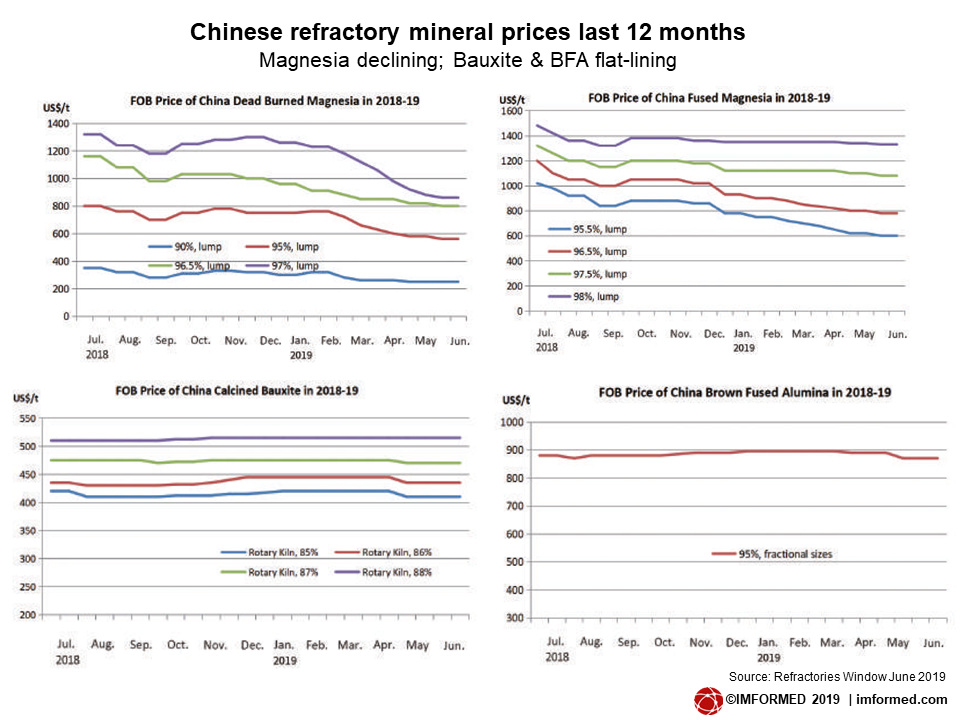

Ali made several recommendations for the industry including detailed exploration so that workable reserves are identified and opened for mining, eg. fireclays and graphite; a thrust on beneficiation to improve low grade minerals, eg. bauxites and magnesites; sintering plants /fusion plants should be set up to increase the capacity eg. of fused chrome, fused magnesite.

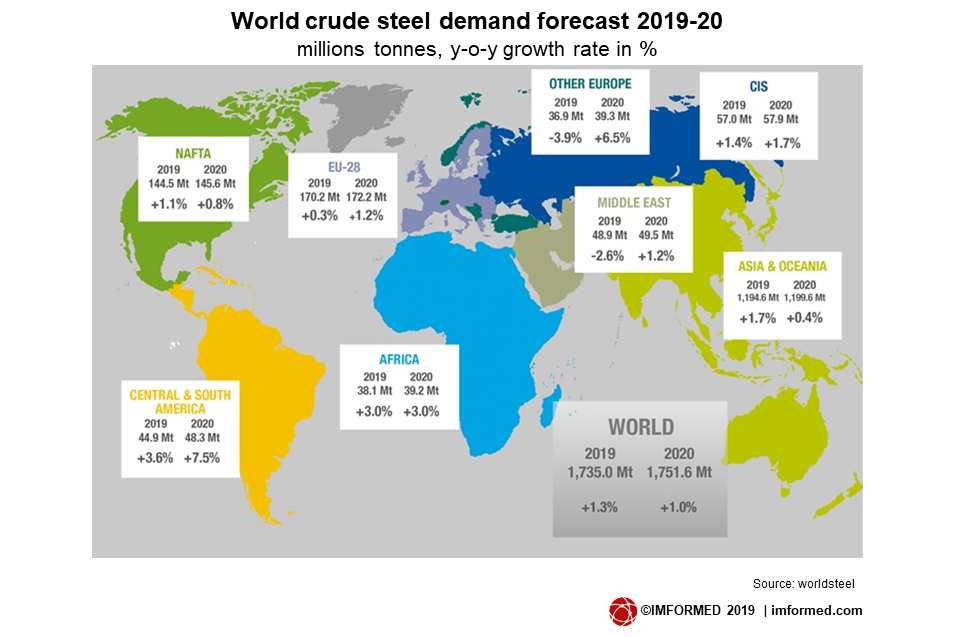

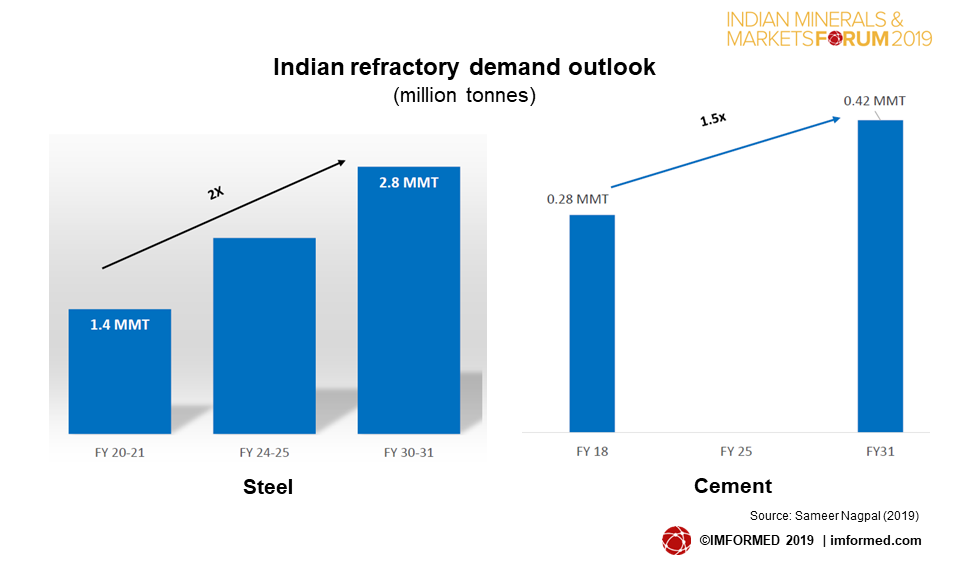

Sameer Nagpal, CEO, Dalmia OCL Ltd, India, presented “Overview of supply and demand of India’s refractories” and reviewed the overall refractories market demand before focusing on India.

With several major infrastructure projects in the pipeline, Nagpal expects steel refractories demand in India to double from 1.4m tonnes in FY20-21 to 2.8m tonnes in FY30-31, and cement refractories demand to increase from 0.28m tonnes in FY18 to 0.42m tonnes in FY31.

“The Indian market is the only one showing this trend – it is the most exciting refractories market in the world”. said Nagpal ![DSC_0943]()

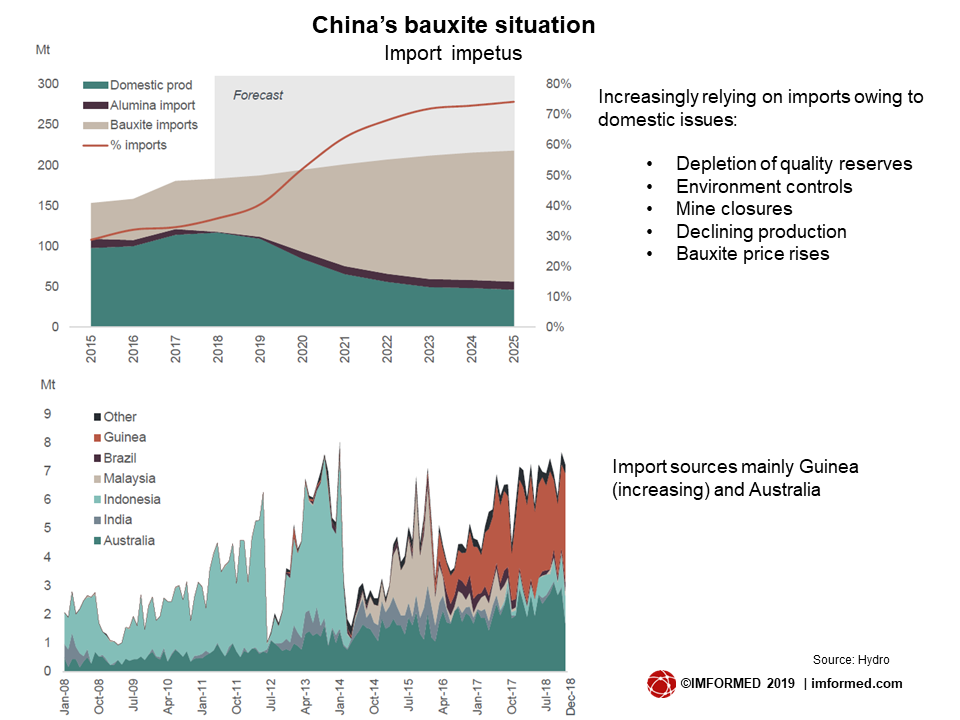

However, Nagpal also lamented the state of India’s refractory mineral development, warning: “It is to risky to rely 100% on China for refractory raw materials. This should be made an issue of national importance.”

He concluded that there is a need for local processing of minerals to support refractory making in India; there needs to be closer working with the government for exploration of refractory minerals; and minerals should get priority attention from the government.

![Nagpal ref forecast]()

![DSC_0947]() “Kyanite in refractories: Indian economic drivers & markets” by Aditya Newalkar, Executive Director, Maharashtra Minerals Corp. Ltd, homed in on one of India’s refractory minerals in high demand, about which Hakimuddin Ali had earlier urged “an urgent need to convert resources into reserves”.

“Kyanite in refractories: Indian economic drivers & markets” by Aditya Newalkar, Executive Director, Maharashtra Minerals Corp. Ltd, homed in on one of India’s refractory minerals in high demand, about which Hakimuddin Ali had earlier urged “an urgent need to convert resources into reserves”.

Newalkar reviewed world kyanite supply and demand, commenting that Indian reserves were restricted mainly to Jharkhand (76%) and Maharashtra (24%) states, and concentrated around Singhbhum and Bhandara, respectively, and owned mostly by private companies.

Indian kyanite production has remained just under 70,000 tpa since 2013. MMCL has some 925,000 tonnes of mineable reserves, and has developed kyanite beneficiation processing technology jointly with NML Jamshedpur to beneficiate low to mid grade kyanite (40-58% Al2O3) on a pilot scale.

MMCL is seeking strategic partnerships to realise its objectives to re-initiate kyanite production, and install a higher capacity beneficiation plant with modern technology.![DSC_0949]()

In “Secondary raw materials for refractory industry” Dr. Nilachala Sahoo, Director (Technical), Chaitanya Refractory Pvt Ltd/Global Recycling, India, outlined his company’s activities in reprocessing of waste refractory products and making usable refractory raw materials, and R & D work to use different industrial wastes as refractory raw materials and commercialisation of the developed process.

Chaitanya Refractory and associate Global Recycling are processing and marketing about 2,000 tpm secondary refractory raw materials.

Sahoo supported this with a range of examples including MgO grains from recycled magnesia-carbon bricks; fused AZS grains; and fused alumina chrome.

Ashapura invited delegates to a fabulous “Bollywood Nights” Reception with a spectacular dance troupe and band performing a range of dance and music from Maharashtra and Gujarat. Much to everyone’s horror, not least their own, IMFORMED was invited on stage to join in!

![IMG_7783]()

![IMG_7784]()

Feldspar, quartz & plastics markets

![DSC_0951]() “Feldspar and quartz production and markets” by Dr. V. Balasubramaniam, Director, Gaangey Minerals Pvt. Ltd, Gimpex Group, India, highlighted the industrial mineral activities of the Gimpex Group, which included on 4 July 2019 Gimpex’s wholly owned subsidiary Gaangey Minerals Pvt. Ltd acquiring 100% shares of the feldspar process plant with all 11 mines from Sibelco in Balanagar near Hyderabad, Telangana.

“Feldspar and quartz production and markets” by Dr. V. Balasubramaniam, Director, Gaangey Minerals Pvt. Ltd, Gimpex Group, India, highlighted the industrial mineral activities of the Gimpex Group, which included on 4 July 2019 Gimpex’s wholly owned subsidiary Gaangey Minerals Pvt. Ltd acquiring 100% shares of the feldspar process plant with all 11 mines from Sibelco in Balanagar near Hyderabad, Telangana.

Dr Balasubramaniam reviewed world feldspar supply and demand and described Gaangey Minerals’ facilities of which the Balanagar plant has a capacity of 300,000 tpa feldspar. The company also produces quartz for a range of markets.

![DSC_0956]() “Opportunities for Indian filler mineral suppliers in plastics rubber & coating markets” by Samantha Wietlisbach, Principal Analyst Chemicals, IHS Markit, Switzerland, examined the various Indian mineral fillers for these markets, dominated by calcium carbonate, but also using talc and kaolin.

“Opportunities for Indian filler mineral suppliers in plastics rubber & coating markets” by Samantha Wietlisbach, Principal Analyst Chemicals, IHS Markit, Switzerland, examined the various Indian mineral fillers for these markets, dominated by calcium carbonate, but also using talc and kaolin.

Key outlook trends include HDPE blow molding AAGR 8% per year to 2024,flexible PVC applications India AAGR >6%, and growth of ca 10% per year for PLA bio polymers.

Wietlisbach expects calcium carbonate demand in India to grow at 3.3% p.a. up to 2023.

Processing developments

![DSC_0959]() “Wet processing of industrial minerals in India and South East Asia” by Dr. Arabinda Bandyopadhyay, Chief Technologist, CDE Asia Ltd, India, described the company’s activities across the four main sectors of Manufactured Sand Production, Construction & Demolition Waste Recycling, Industrial Sand Processing, and Mineral Processing.

“Wet processing of industrial minerals in India and South East Asia” by Dr. Arabinda Bandyopadhyay, Chief Technologist, CDE Asia Ltd, India, described the company’s activities across the four main sectors of Manufactured Sand Production, Construction & Demolition Waste Recycling, Industrial Sand Processing, and Mineral Processing.

Patented minerals processing machines used for processing minerals such as limestone, bauxite, and chromite were illustrated.

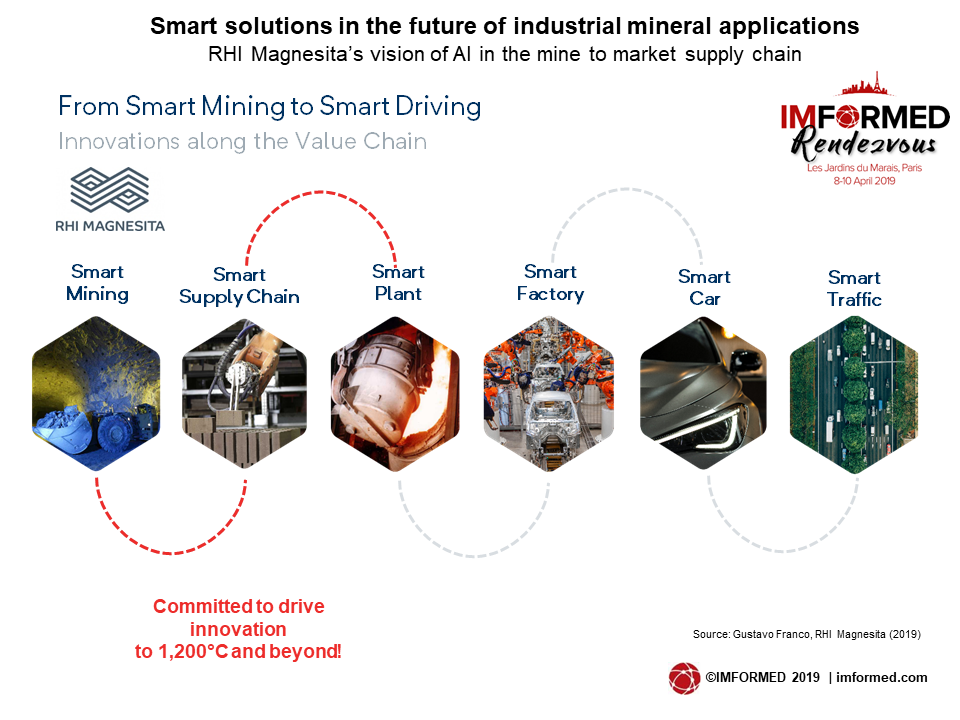

“Future oriented processing technology for high-end industrial minerals and their applications” by Dietmar Alber, Business Development Director, Minerals & Metals Division, Hosokawa Alpine AG, Germany, examined the challenges in the processing market to meet today’s mineral demands.

![DSC_0963]() Chief among these are targeting finer products at the highest quality, consistency and profitability; demands of new and high end industrial mineral applications; end to end cost efficiency solution through optimised process control; and the influence of particle shape and size in the end applications and how to control it, by use of the latest powder processing technology.

Chief among these are targeting finer products at the highest quality, consistency and profitability; demands of new and high end industrial mineral applications; end to end cost efficiency solution through optimised process control; and the influence of particle shape and size in the end applications and how to control it, by use of the latest powder processing technology.

Key trends include dry processing of these fine powders down to the submicron range; low energy solutions are required; master tailored particle size distributions and “shaping” of particles; and much bigger sized production capacities/plants.

![DSC_0966]() “Water-free electrostatic processing of fine minerals” by Kyle Flynn, Sales Engineer, ST Equipment & Technology, USA, was subject to one of the longest Q&A sessions after the presentation, reflecting delegates’ interest in this dry separation technology.

“Water-free electrostatic processing of fine minerals” by Kyle Flynn, Sales Engineer, ST Equipment & Technology, USA, was subject to one of the longest Q&A sessions after the presentation, reflecting delegates’ interest in this dry separation technology.

Vast quantities of fresh water are used each year for minerals processing, estimates range from 1,000-4,000 litres/tonne of ore. Flynn noted that South East Asia, and India especially, face a critical shortage of fresh water.

STET’s process requires low energy consumption (1-2 kWh/tonne feed), makes consistent product from highly variable feed material, and is very efficient at fines and ultra-fines. Flynn illustrated with examples for fly ash, calcium carbonate, bauxite, talc, and barite.

Electric markets: driving future mineral demand

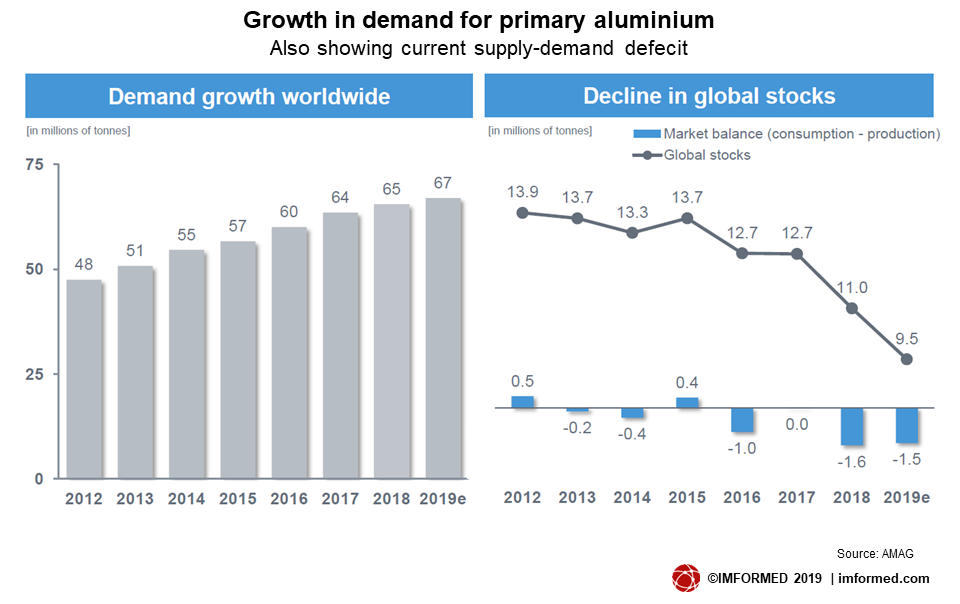

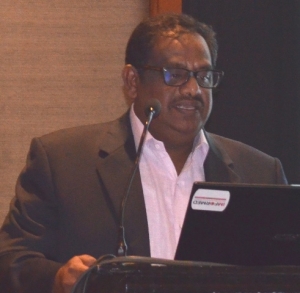

“Minerals for the electrification of India” by Dr Richard Flook, Managing Director, Mosman Resources, Australia, was a comprehensive evaluation of electricity generation trends, India power and electricity mission, Indian electric news, electric vehicle minerals, solar energy minerals, and why we should look at Australia and India.

![DSC_0978]() Flook commented on the Indian Cabinet decision (7 March 2019) to set up the National Mission on Transformative Mobility and Battery Storage with its mission to formulate and launch a Phased Manufacturing Program with a focus on batteries including: raw materials, electrochemistry, end of life treatment (recycling), manufacture of cells, modules, battery packs usage in vehicles. India is also expected to be fourth largest electrical storage market.

Flook commented on the Indian Cabinet decision (7 March 2019) to set up the National Mission on Transformative Mobility and Battery Storage with its mission to formulate and launch a Phased Manufacturing Program with a focus on batteries including: raw materials, electrochemistry, end of life treatment (recycling), manufacture of cells, modules, battery packs usage in vehicles. India is also expected to be fourth largest electrical storage market.

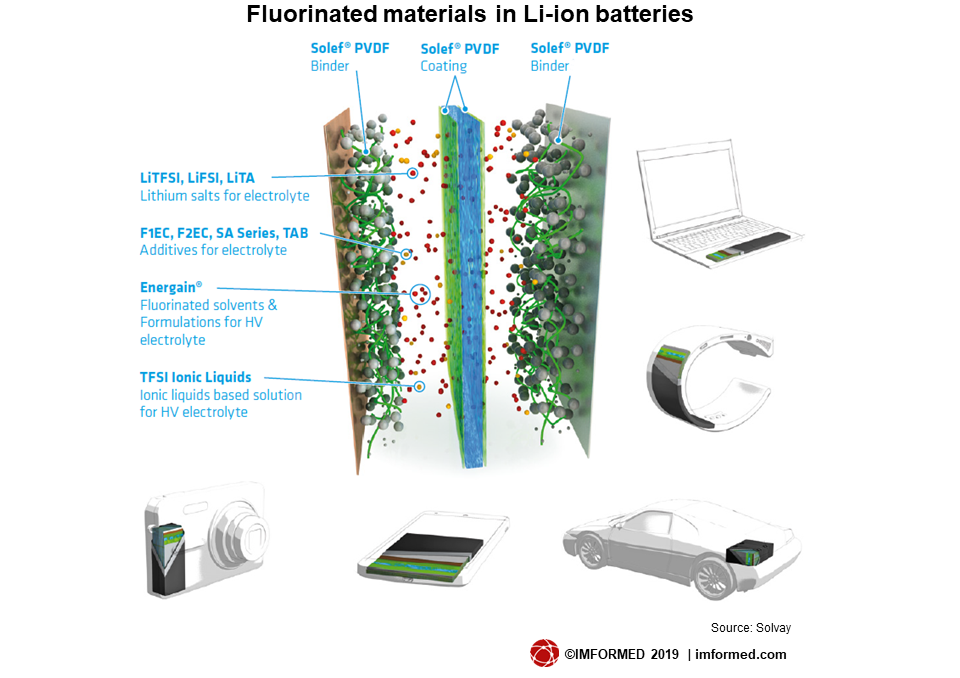

“Giga-scale manufacturing in India will be required. Policy will be to secure materials used in lithium-ion batteries, including lithium, cobalt, nickel, manganese, and graphite & other strategic materials such as rare earths & tungsten.” said Flook.

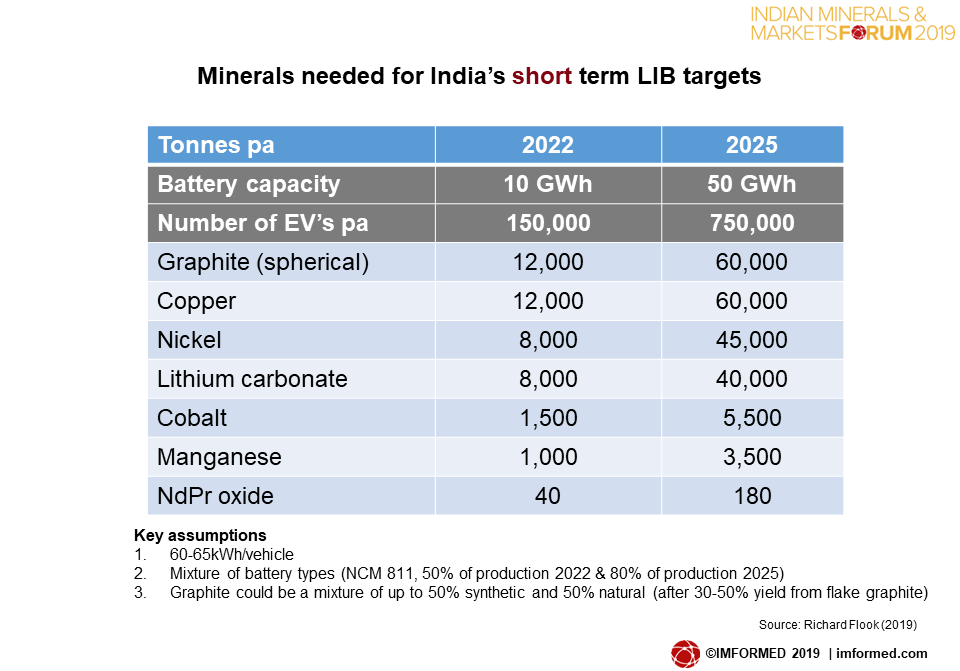

Flook highlighted lithium, graphite, nickel, manganese, high purity alumina, and rare earths supply sources, suggesting some potential in Indian future demands being met with Australian supply, and concluded with estimates of minerals and volumes needed for India‘s short term targets.

![Flook LIB min est]()

![DSC_1145]() “Li-ion batteries – Where we are now and what is the direction of travel?” by Alison Saxby, Director Operations, Roskill, UK, covered a lot of ground including: fundamental drivers, lithium ion battery (LIB) demand, LIB capacity by region, Indian battery companies, and the battery value chain.

“Li-ion batteries – Where we are now and what is the direction of travel?” by Alison Saxby, Director Operations, Roskill, UK, covered a lot of ground including: fundamental drivers, lithium ion battery (LIB) demand, LIB capacity by region, Indian battery companies, and the battery value chain.

For India, Saxby considered that regulation and high purchasing power are the main drivers of EV growth, and forecasts that by 2030 plug-in car sales will reach 1.4m units. “That is still approximately 35% of India auto market today. Cheaper electric vehicles in India with LFP cathode-batteries may revolutionise the market.” said Saxby.

The announced goal of the India government goal is to build four gigafactories with some US$4bn. Saxby compared this to China, where it spent US$60bn in direct and indirect EV subsidies to build a 250GWh/year battery industry in 2018.

“Thus India will likely need more than US$bn, tax breaks, foreign experienced battery companies, and perhaps 5-10 years to build a domestic battery industry. By 2030, most countries will still rely on China’s battery capacity combined with Japanese and South Korean technology and know-how.” concluded Saxby.

New markets for high purity quartz, wollastonite, & graphite

![DSC_1149]() “High purity quartz supply & demand” by Murray Lines, Managing Director, Stratum Resources, Australia, highlighted the very limited world sources of high purity quartz (HPQ) and their high specifications.

“High purity quartz supply & demand” by Murray Lines, Managing Director, Stratum Resources, Australia, highlighted the very limited world sources of high purity quartz (HPQ) and their high specifications.

Indian HPQ production represents just 6% of the world HPQ supply market, supplied by small mines feeding several processing plants centred in Rajasthan.

Lines examined HPQ processing and underlined how crucial this is to its end value, and highlighted the key markets of electronics, solar, construction, medical, optics and other uses.

The Asian HPQ market is forecast to increase from 51,900 tonnes in 2018 to 62,900 tonnes in 2021. This is dominated by China and Japan, with little impact, yet, from India. “India is expected to be an emerging market for high purity quartz. Government initiatives towards promoting semiconductor industries are expected to drive high demand.” said Lines.

“Wollastonite and its market outlook” by Gaurang Singhal, Director, Wolkem India Ltd, India, was a concise summary of the global market for this unique mineral.

World production of about 800,000 tpa is produced by just six countries: China, India, USA, Mexico, Canada, and Finland in descending order of output.

Global demand is projected to grow at 8-10% CAGR, and mostly in China, India, Africa, the Middle East and Asia.![DSC_1154]()

Singhal considered this would easily be met by existing suppliers. However, he acknowledged interest in new wollastonite sources in Canada, Chile, Kenya, Namibia, South Africa, Spain, Sudan, Tajikistan, Turkey, and Uzbekistan.

The key markets remain ceramic and metallurgical applications (50%), construction (15%), polymers (15%), paint & coatings (10%), and others such as friction products, welding, and adhesives (10%).

“But this mix is expected to change” said Singhal, and highlighted other emerging applications in environment controlling CO2 emissions, soil conditioning, phosphorus adsorbent, forest restoration, supplement in sugar cane cultivation, and substituting up to 10% in cement to enhance resistance to carbonation and permeation.

“Graphite developments, markets & India’s mineral challenge” by Puruvi Poddar, Group Manager Business & Project Development, Tirupati Graphite PLC, India, was an excellent review of the global supply and demand of graphite with a focus on Tirupati’s activities.

![DSC_1160]() Poddar gave an overview of African developments and commented on the high demand growth in multiple applications, such as Li-ion batteries, flame retardants, foil and thermal management, composites, recarburisers, fuel cells, lubrication, and graphene.

Poddar gave an overview of African developments and commented on the high demand growth in multiple applications, such as Li-ion batteries, flame retardants, foil and thermal management, composites, recarburisers, fuel cells, lubrication, and graphene.

A phased approach across the value chain by Tirupati was outlined, with reference to the company’s recent Vatomina and Sahamamy graphite mine projects in Madagascar, downstream plant expansion at Tirupati Specialty Graphite in India (expandable graphite for flame retardants), and Tirupati Graphene & Mintech Research Center, also in India.

Neatly bringing the conference full circle, Poddar concluded with a reminder of issues influencing India’s wider “mineral challenge”:

- over the past five years no new mine has come into production

- exploration is required to be undertaken across various kinds of minerals

- the framework for grant of concessions for niche minerals may need a relook as the current auction process may not be workable. Graphite is an example of this

- a focus on development and implementation of green mining technologies.

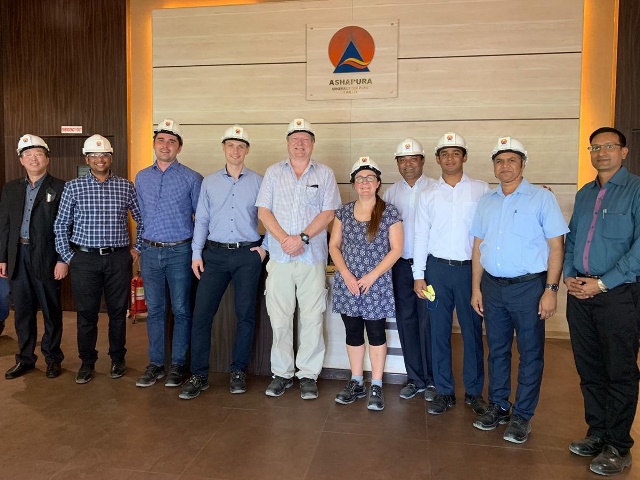

Field Trip: visit to Ashapura operations in Kutch, Gujarat

![FT1]()

![FT2]()

IMFORMED would like to express special thanks to Ashapura for organising a superb field trip to Kutch, Gujarat to see its bentonite & bauxite mines; Baraya Minerals Complex (bentonite; calcined bauxite & kaolins; GCC; geosynthetic clay liners); Perfoclay plant (bentonite, attapulgite bleaching earths) and R&D Centre; with a finale visit to the unique and inspiring Vande Mataram Memorial.

The Baraya complex comprises five plants supplied by raw material from surrounding mines within a 150-200km radius, with the following production capacities:

- Bentonite 420,000 tpa (Ca-bentonite, treated with soda ash)

- Ground calcium carbonate 60,000 tpa (raw material imported from Egypt)

- Sintered brown tabular alumina 60,000 tpa (from calcined bauxite; 87%, 89%, 91%, 95% Al2O3 grades)

- Chamotte 40,000 tpa (calcining kaolin in a 55 x 25m dia. rotary kiln; 42%, 46% Al2O3)

- Geosynthetic clay liners 3m sq metres

The Perfoclay plant, covering 100 acres, produces 250,000 tpa of bleaching earths from 8 production lines based mainly on sulphuric acid treated Ca-bentonite, but also using calcined attapulgite from Ashapura’s mines. It is the single largest plant of its kind in the world supplying the edible oils and petrochemical catalyst markets, and enabling Ashapura to account for 80% of the domestic market; about 40% of output is exported.

![VMM pic]() Giving back to society has been one of Chetan Shah’s core tenets, and over the years his philanthropic zest through the Ashapura Foundation has touched thousands of lives through initiatives in water harvesting, education, vocational training, women’s empowerment, and social upliftment through the restoration and promotion of arts & crafts from Gujarat. This is none more so evident than at the spectacular Vande Mataram Memorial at Bhuj – a unique 4D non-profit national monument dedicated to India’s freedom struggle from the revolt of 1857 to the country’s Independence in 1947.

Giving back to society has been one of Chetan Shah’s core tenets, and over the years his philanthropic zest through the Ashapura Foundation has touched thousands of lives through initiatives in water harvesting, education, vocational training, women’s empowerment, and social upliftment through the restoration and promotion of arts & crafts from Gujarat. This is none more so evident than at the spectacular Vande Mataram Memorial at Bhuj – a unique 4D non-profit national monument dedicated to India’s freedom struggle from the revolt of 1857 to the country’s Independence in 1947.

The memorial complex is over 10 acres of land, with the 100,000 sq. ft museum modelled on the likeness of the “Sansad Bhavan” (the Indian Parliament Building). It took four years to build at a cost of about INR600m.(US$8.3m.) and was completed in 2017.

A secondary structure of 50,000 sq.ft is modelled on the Agra Fort (Red Fort), hosting a special gallery of freedom fighters from Gujarat. There is also a “village” hosting workshops making a range of local arts and crafts.

![Ash FT]()

Thank you, and see you again in 2020!

As ever we are indebted to the support and participation of all of our sponsors, exhibitors, speakers, and delegates for making Indian Minerals & Markets Forum 2019 such a success.

We very much appreciate all the completed feedback forms and please continue to provide us with your thoughts and suggestions.

We look forward to meeting you at one of our Forums in 2020.

Registration, Sponsor & Exhibit enquiries: Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

Presentation & programme enquiries: Mike O’Driscoll T: +44 (0)7985 986255 mike@imformed.com

Missed attending the Indian Minerals Forum?

Copies of presentations maybe purchased.

Please contact Ismene Clarke T: +44 (0)7905 771 494 ismene@imformed.com

engineering, energy, China, other trends, and the industrial minerals industry.

engineering, energy, China, other trends, and the industrial minerals industry.

Alber reviewed various milling systems for industrial minerals according to their fineness and energy consumption, including the latest key steps in ground calcium carbonate processing to cope with high quality markets.

Alber reviewed various milling systems for industrial minerals according to their fineness and energy consumption, including the latest key steps in ground calcium carbonate processing to cope with high quality markets. “Fine grinding & classifying: a new concept in mobility & modularity” by Jean-Francois Maréchal, Managing Director, Poittemill, France, introduced his company’s new Truckmill concept – a mobile modular drying and fine grinding system.

“Fine grinding & classifying: a new concept in mobility & modularity” by Jean-Francois Maréchal, Managing Director, Poittemill, France, introduced his company’s new Truckmill concept – a mobile modular drying and fine grinding system.

Chanet showed how Control Union and Wageningen University researched semi-automated volume calculation for bulk cargo using LIDAR technology (light detection and ranging).

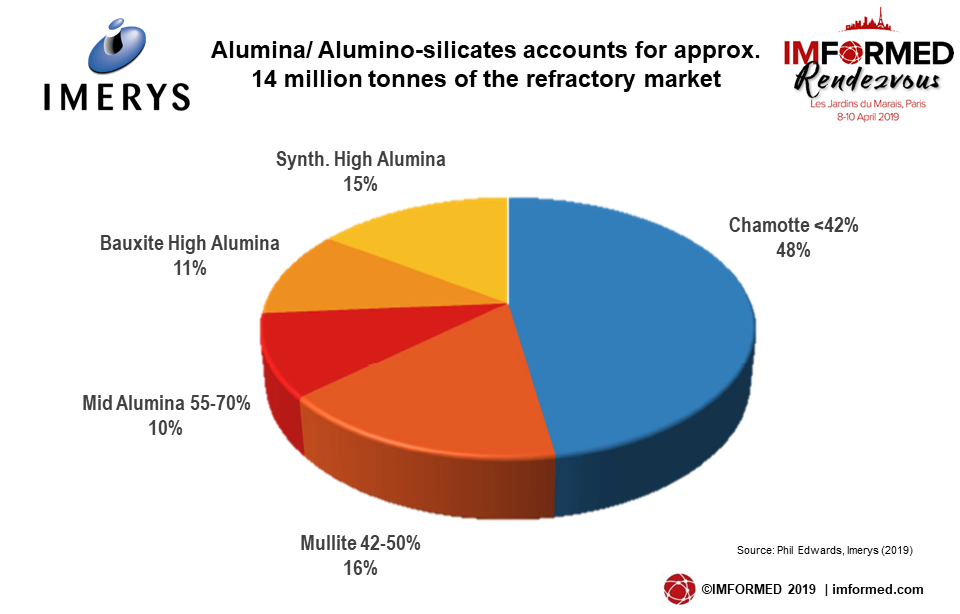

Chanet showed how Control Union and Wageningen University researched semi-automated volume calculation for bulk cargo using LIDAR technology (light detection and ranging). “Refractory solutions have changed with the understanding of processes, but finished products remain extremely exposed to disruptions in [raw material] trade flows.” reflected Edwards.

“Refractory solutions have changed with the understanding of processes, but finished products remain extremely exposed to disruptions in [raw material] trade flows.” reflected Edwards.

outlook for demand for calcium carbonate in plastics and coatings.

outlook for demand for calcium carbonate in plastics and coatings. Wilson took the audience through paper minerals used and their shape and size, detailing kaolin and PCC, the view from paper machine manufacturer Valmet, mineral use by leading paper manufacturer Stora Enso, ending with summaries of the market situation in Japan and China.

Wilson took the audience through paper minerals used and their shape and size, detailing kaolin and PCC, the view from paper machine manufacturer Valmet, mineral use by leading paper manufacturer Stora Enso, ending with summaries of the market situation in Japan and China.

In particular, attention was drawn to Pakistan exports which have increased from 6,000t in 2014 to 80,000t in 2018, mainly to India but also to Greece and China in 2018, and are forecast in total to reach 95,000t in 2019.

In particular, attention was drawn to Pakistan exports which have increased from 6,000t in 2014 to 80,000t in 2018, mainly to India but also to Greece and China in 2018, and are forecast in total to reach 95,000t in 2019.

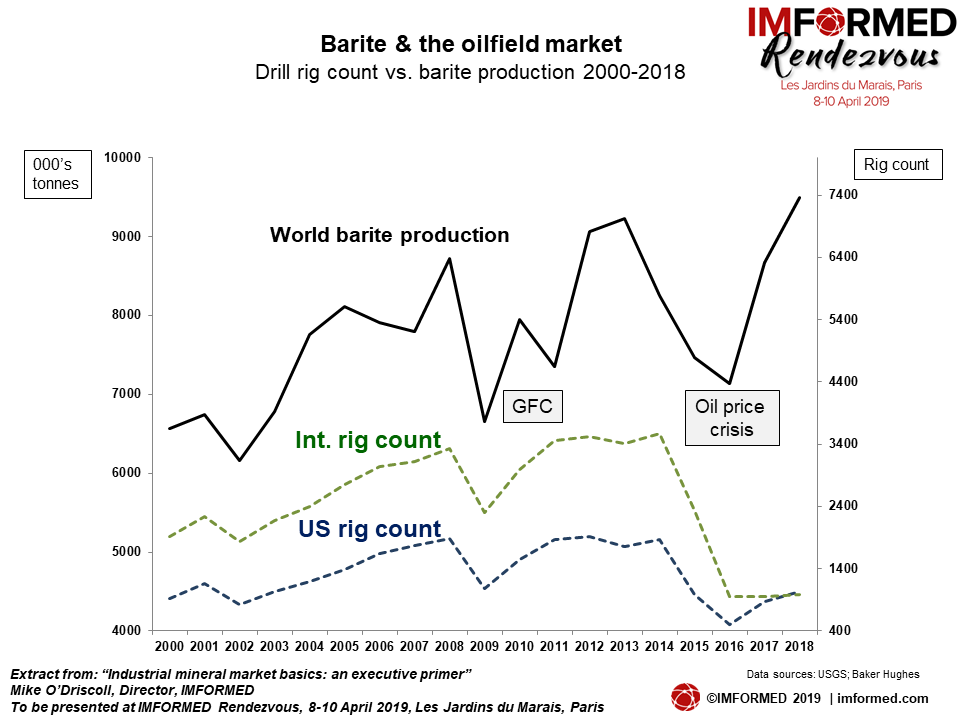

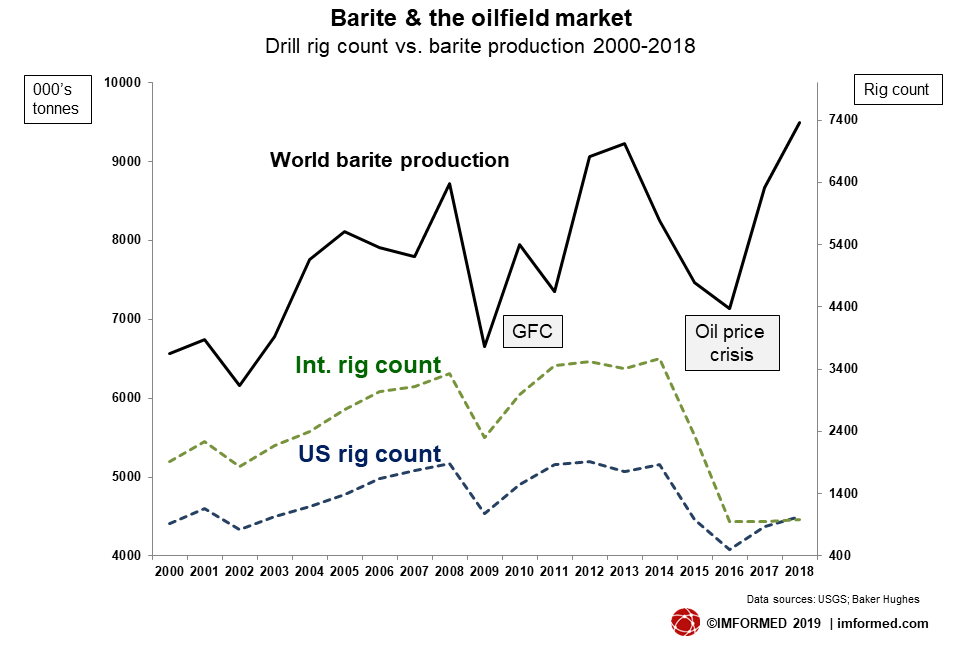

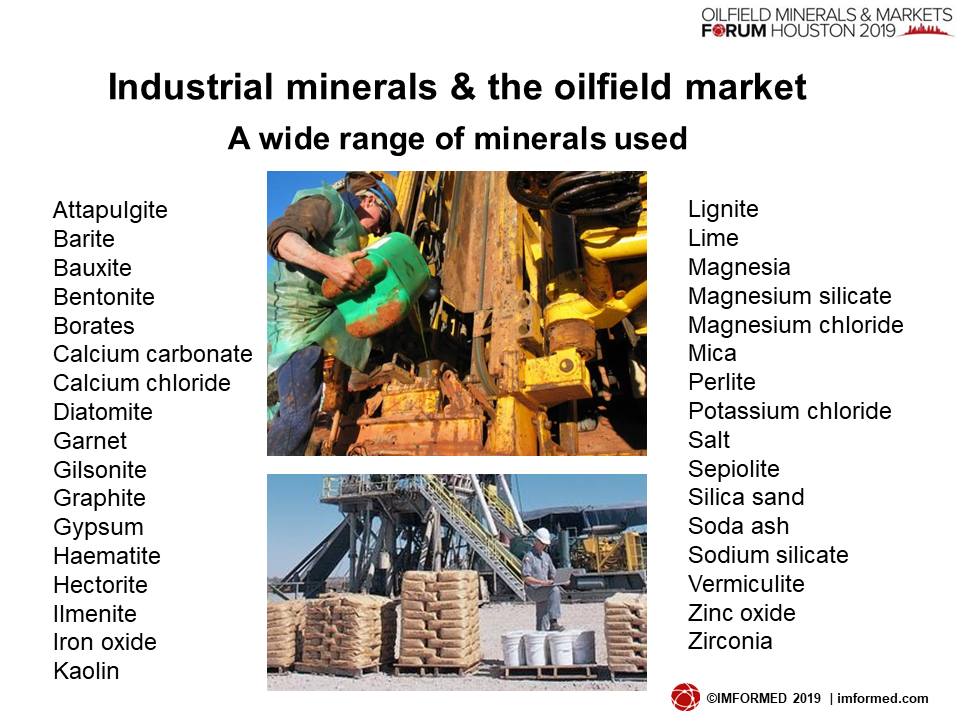

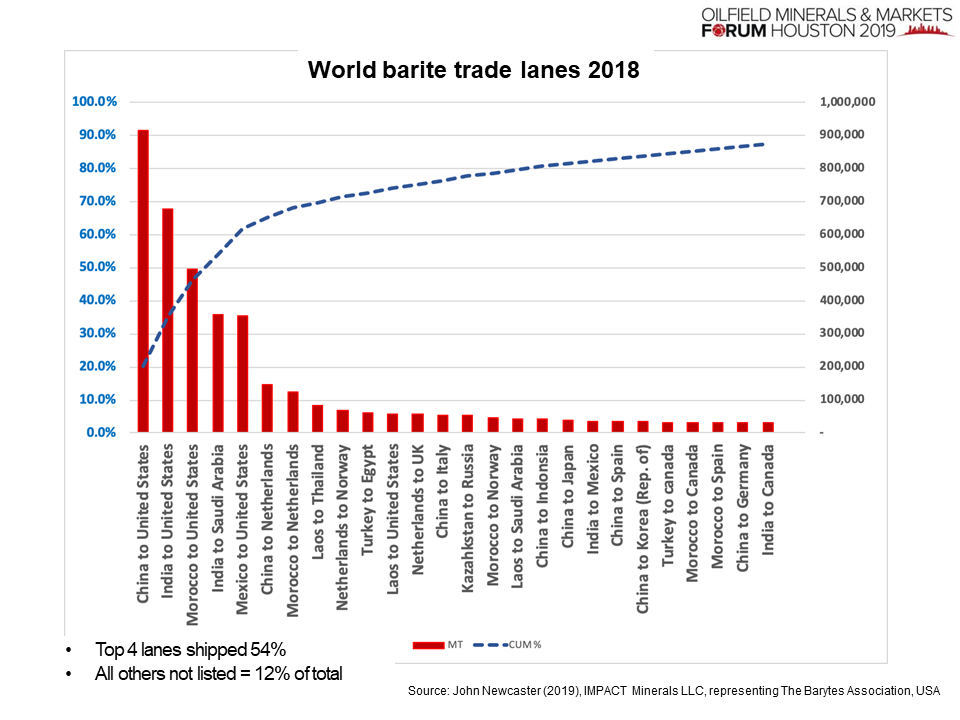

Other mineral demand factors included concerns over adequate mineral supply and quality (particularly bromides), a lack of alternative materials and market-ready sources, and that volume consumption of speciality products, such as fine grain weighting material, is likely to continue to increase.

Other mineral demand factors included concerns over adequate mineral supply and quality (particularly bromides), a lack of alternative materials and market-ready sources, and that volume consumption of speciality products, such as fine grain weighting material, is likely to continue to increase.

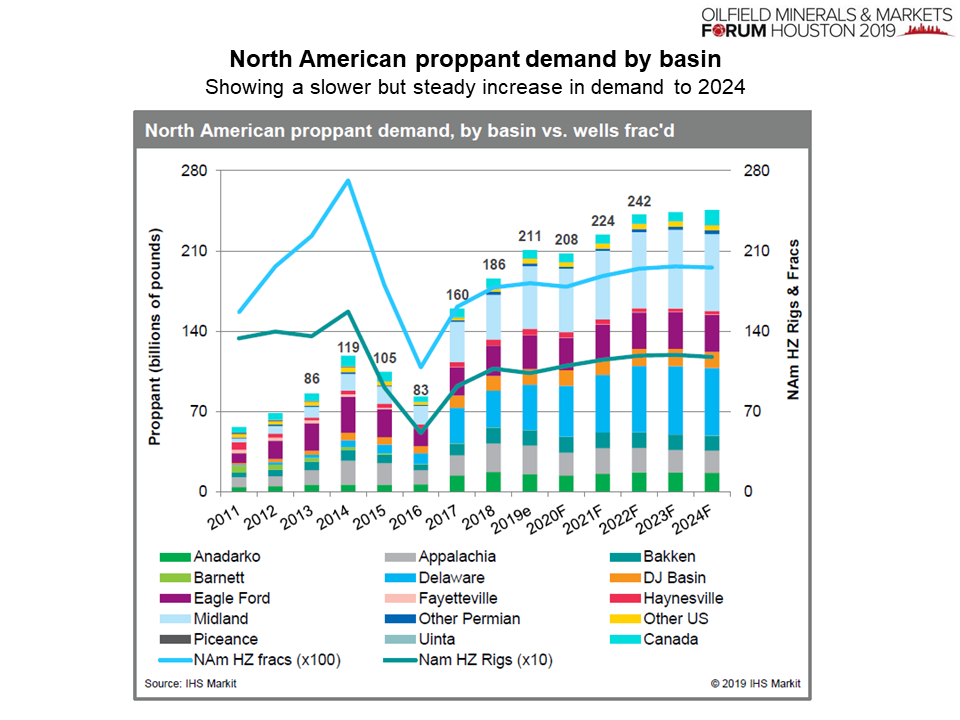

Key trends for H1 2019 have included “an immediate shift to survival of the financial and operational fittest in a lingering state of [fact sand] oversupply and an unfavourable pricing environment for suppliers”.

Key trends for H1 2019 have included “an immediate shift to survival of the financial and operational fittest in a lingering state of [fact sand] oversupply and an unfavourable pricing environment for suppliers”.

Newcaster kicked off with a reminder that barite is listed as one of the 35 US critical minerals, and informed the audience of the 4 June 2019 publication of a Federal Report detailing strategy and plans that involve all agencies in increasing discovery, production, and domestic refining of critical minerals.

Newcaster kicked off with a reminder that barite is listed as one of the 35 US critical minerals, and informed the audience of the 4 June 2019 publication of a Federal Report detailing strategy and plans that involve all agencies in increasing discovery, production, and domestic refining of critical minerals.

However, over the last 15 years reserves have been depleted with some small developments in Chile. Brazil, Argentina and Colombia started importing powder or ore to support their operations in country but challenges include inadequate logistics infrastructure, outdated or inadequate grinding capabilities in country, and cross-border risks.

However, over the last 15 years reserves have been depleted with some small developments in Chile. Brazil, Argentina and Colombia started importing powder or ore to support their operations in country but challenges include inadequate logistics infrastructure, outdated or inadequate grinding capabilities in country, and cross-border risks.

The STET Separation is effective at upgrading low-grade barite to drilling-grade by removal of low density silicates. A full-scale separator is now operating at Ramadas Minerals, Kodur India.

The STET Separation is effective at upgrading low-grade barite to drilling-grade by removal of low density silicates. A full-scale separator is now operating at Ramadas Minerals, Kodur India.

Rhode asked the audience if lessons had been learned over the last decade, noting that many of the key issues and questions in 2009 remain just as apt in today’s market.

Rhode asked the audience if lessons had been learned over the last decade, noting that many of the key issues and questions in 2009 remain just as apt in today’s market.

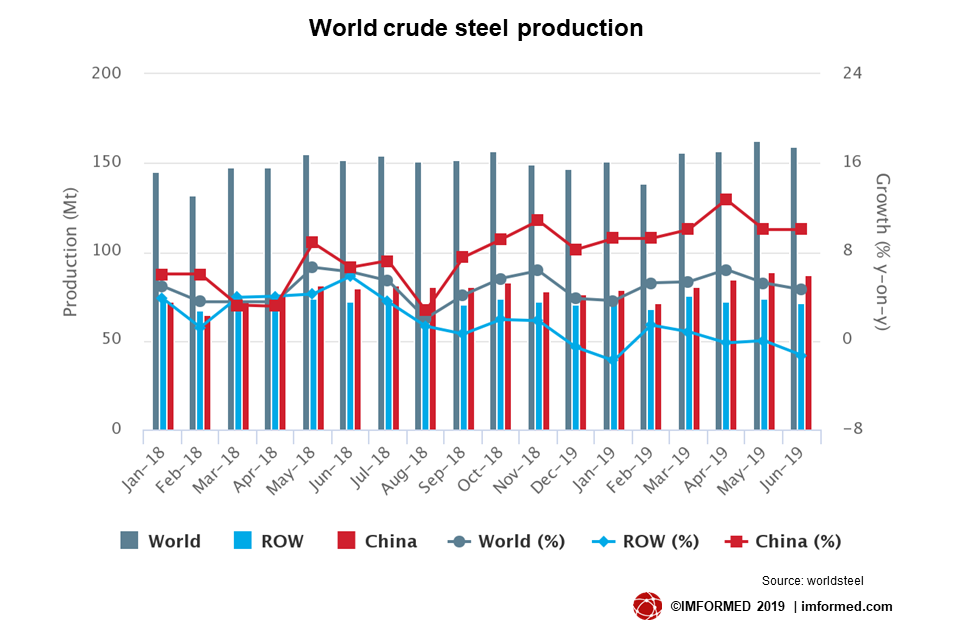

Shinh commented that global economic growth is set to moderate in the near term, with GDP growth falling to around 3% p.a. and Chinese GDP is projected to slow to around 6%.

Shinh commented that global economic growth is set to moderate in the near term, with GDP growth falling to around 3% p.a. and Chinese GDP is projected to slow to around 6%.

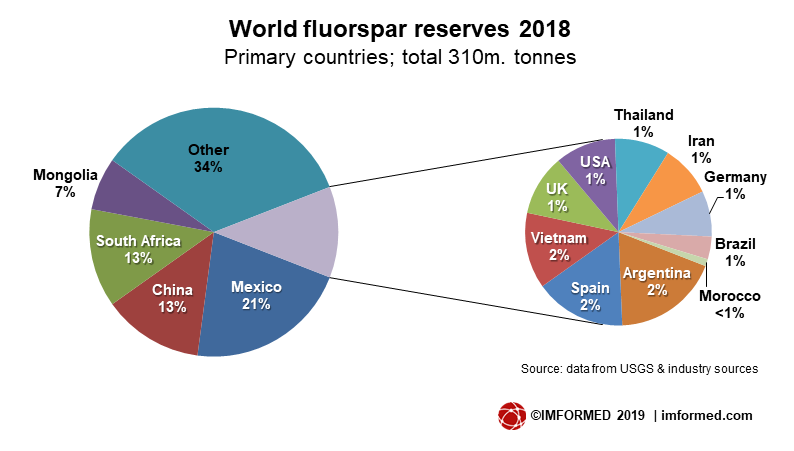

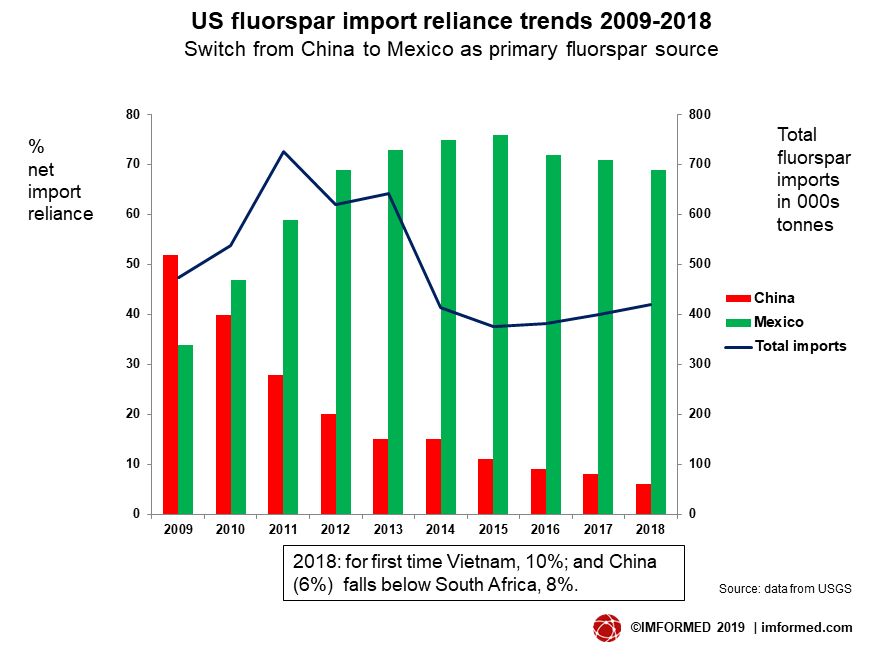

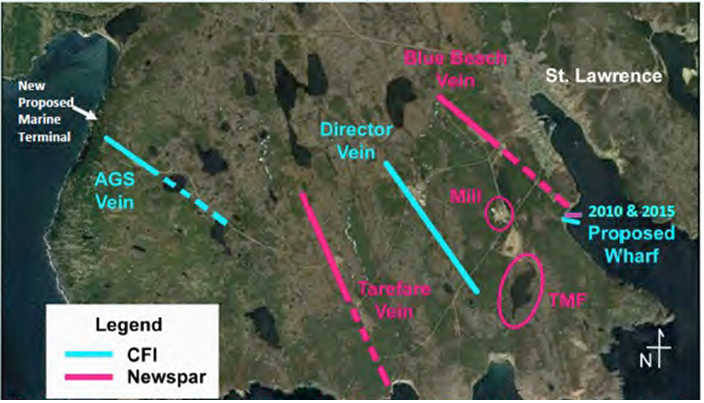

However, the 1990s saw major changes – Chinese imports, domestic industry restructuring, declining use of metspar in steel plants, HF manufacture ceased – which eventually closed the mines in 1995.

However, the 1990s saw major changes – Chinese imports, domestic industry restructuring, declining use of metspar in steel plants, HF manufacture ceased – which eventually closed the mines in 1995.

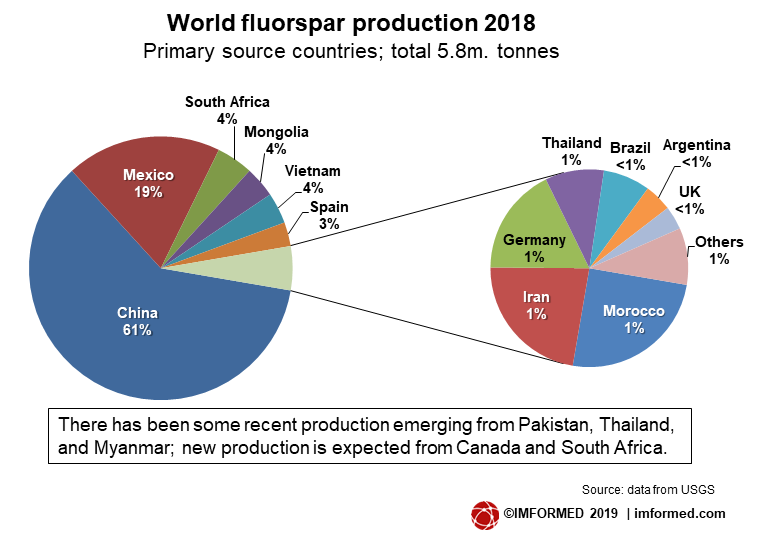

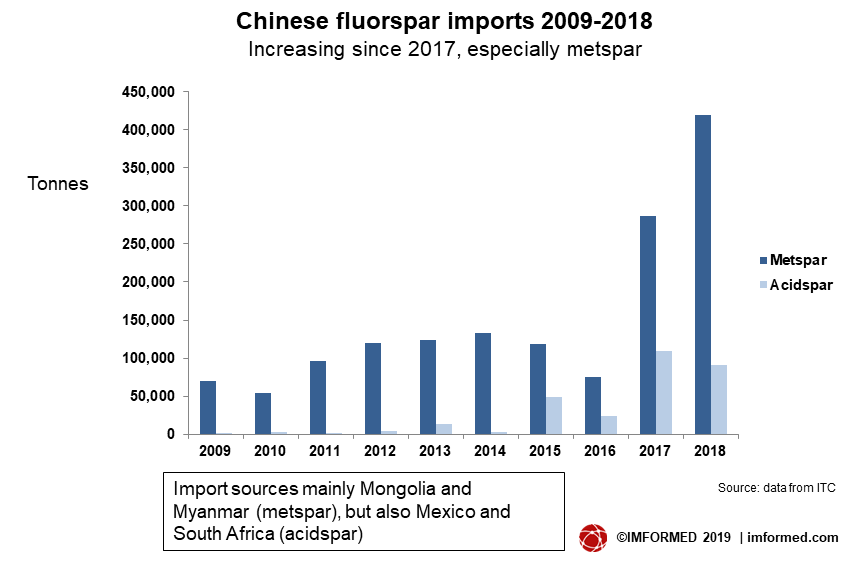

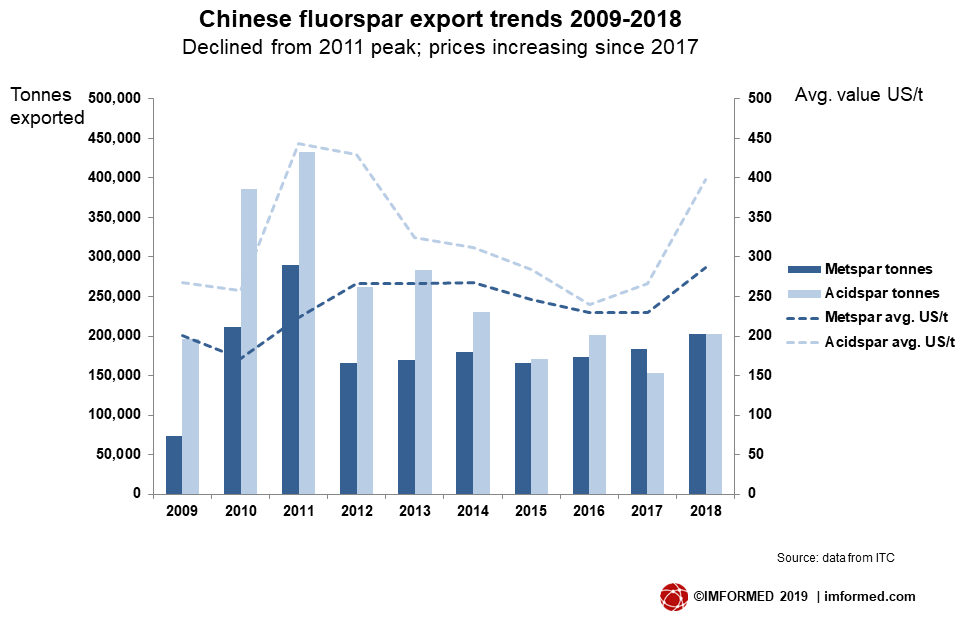

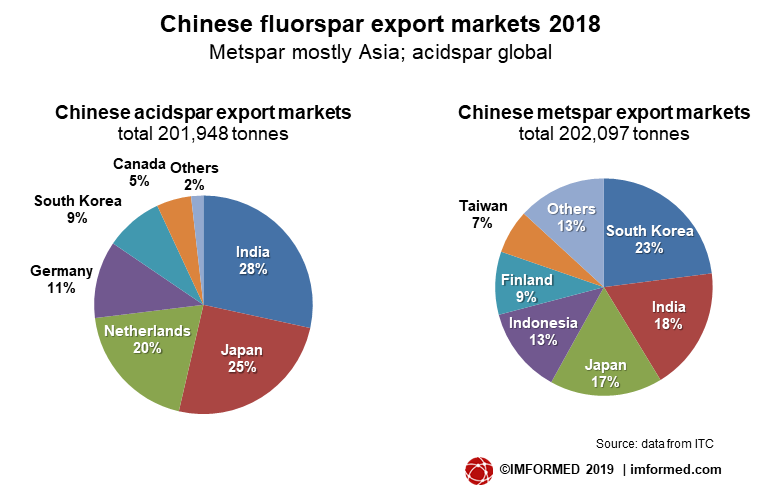

“The development of China’s fluorite industry” by Usman Khan, CEO, Kcomber Inc., China, covered prices of Chinese fluorochemicals, fluorspar production, consumption, prices and trade, and outlook trends.

“The development of China’s fluorite industry” by Usman Khan, CEO, Kcomber Inc., China, covered prices of Chinese fluorochemicals, fluorspar production, consumption, prices and trade, and outlook trends.

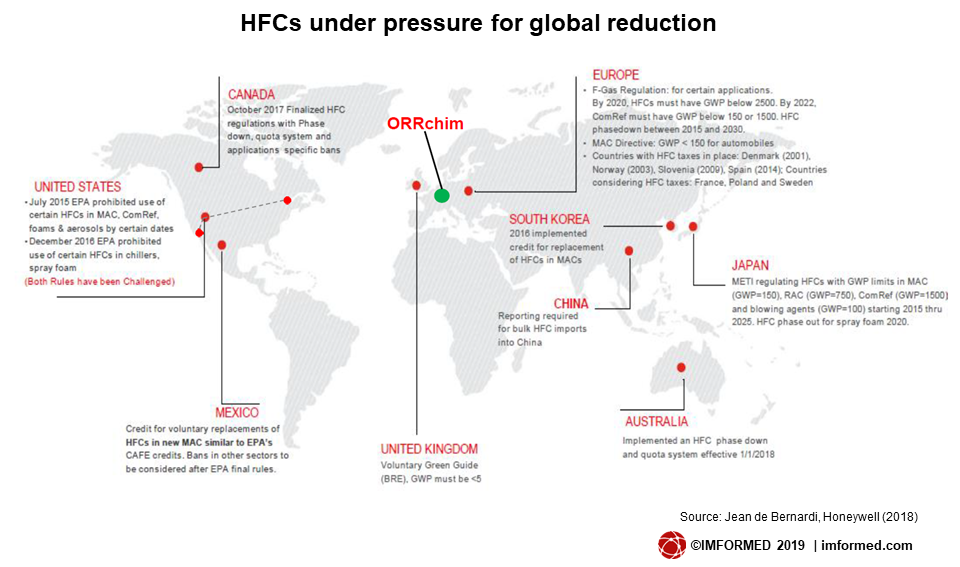

“The evolution of refrigerant gas and the role of Chemours in the market” by John Zielinski, Executive Buyer Fluoroproducts, Chemours, USA, reviewed Chemours fluorochemical products and the UN’s sustainable development goals before highlighting the environmental challenges driving industry transitions, ie. the recent global Kigali Amendment: HFC Phase-Down and the earlier Montreal Protocol: R-22 Phase-Out.

“The evolution of refrigerant gas and the role of Chemours in the market” by John Zielinski, Executive Buyer Fluoroproducts, Chemours, USA, reviewed Chemours fluorochemical products and the UN’s sustainable development goals before highlighting the environmental challenges driving industry transitions, ie. the recent global Kigali Amendment: HFC Phase-Down and the earlier Montreal Protocol: R-22 Phase-Out.

Scheruhn underlined a number of drivers, such the EU Resource Risk Assessment, trade wars, and climate agreements, which have shifted focus onto a new outlook involving new downstream industries, specifically Li-ion batteries (LIB) in EVs.

Scheruhn underlined a number of drivers, such the EU Resource Risk Assessment, trade wars, and climate agreements, which have shifted focus onto a new outlook involving new downstream industries, specifically Li-ion batteries (LIB) in EVs.

A 250 tpa plant was completed in mid-2018 and results sent to various institutions including the Russian Council of Science and Technology. In September 2019, agreement was reached to build a large scale plant to recover AHF from DUHF.

A 250 tpa plant was completed in mid-2018 and results sent to various institutions including the Russian Council of Science and Technology. In September 2019, agreement was reached to build a large scale plant to recover AHF from DUHF.

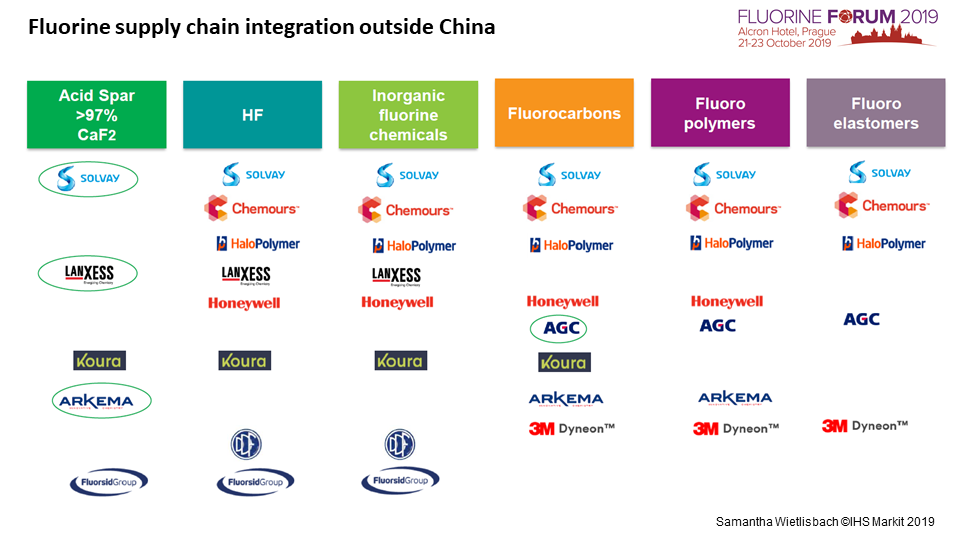

“Downstream markets for fluorochemicals, through to fluoropolymers and fluoroelastomers” by Samantha Wietlisbach, Principal Analyst, Chemical, IHS Markit, Switzerland, was as ever a detailed dissection of the fluorspar supply chain, fluorocarbons, fluoropolymers, fluoroelastomers, and level of integration in the fluorochemical chain.

“Downstream markets for fluorochemicals, through to fluoropolymers and fluoroelastomers” by Samantha Wietlisbach, Principal Analyst, Chemical, IHS Markit, Switzerland, was as ever a detailed dissection of the fluorspar supply chain, fluorocarbons, fluoropolymers, fluoroelastomers, and level of integration in the fluorochemical chain.

“India’s true mining and exploration potential is yet to be tapped, and offer opportunities for investors. New Government policies and regulations should positively impact the sector’s growth in the near future. But, India needs to adopt advanced mining practices, equipment as well as standards for safety and environment.” said Evans.

“India’s true mining and exploration potential is yet to be tapped, and offer opportunities for investors. New Government policies and regulations should positively impact the sector’s growth in the near future. But, India needs to adopt advanced mining practices, equipment as well as standards for safety and environment.” said Evans.

“The refractory industry is crushed between the two big rollers of suppliers and end users.” said Ali.

“The refractory industry is crushed between the two big rollers of suppliers and end users.” said Ali.

“Kyanite in refractories: Indian economic drivers & markets” by Aditya Newalkar, Executive Director,

“Kyanite in refractories: Indian economic drivers & markets” by Aditya Newalkar, Executive Director,

“Feldspar and quartz production and markets” by Dr. V. Balasubramaniam, Director,

“Feldspar and quartz production and markets” by Dr. V. Balasubramaniam, Director,  “Opportunities for Indian filler mineral suppliers in plastics rubber & coating markets” by Samantha Wietlisbach, Principal Analyst Chemicals,

“Opportunities for Indian filler mineral suppliers in plastics rubber & coating markets” by Samantha Wietlisbach, Principal Analyst Chemicals,  “Wet processing of industrial minerals in India and South East Asia” by Dr. Arabinda Bandyopadhyay, Chief Technologist,

“Wet processing of industrial minerals in India and South East Asia” by Dr. Arabinda Bandyopadhyay, Chief Technologist,  Chief among these are targeting finer products at the highest quality, consistency and profitability; demands of new and high end industrial mineral applications; end to end cost efficiency solution through optimised process control; and the influence of particle shape and size in the end applications and how to control it, by use of the latest powder processing technology.

Chief among these are targeting finer products at the highest quality, consistency and profitability; demands of new and high end industrial mineral applications; end to end cost efficiency solution through optimised process control; and the influence of particle shape and size in the end applications and how to control it, by use of the latest powder processing technology. “Water-free electrostatic processing of fine minerals” by Kyle Flynn, Sales Engineer,

“Water-free electrostatic processing of fine minerals” by Kyle Flynn, Sales Engineer,  Flook commented on the Indian Cabinet decision (7 March 2019) to set up the National Mission on Transformative Mobility and Battery Storage with its mission to formulate and launch a Phased Manufacturing Program with a focus on batteries including: raw materials, electrochemistry, end of life treatment (recycling), manufacture of cells, modules, battery packs usage in vehicles. India is also expected to be fourth largest electrical storage market.

Flook commented on the Indian Cabinet decision (7 March 2019) to set up the National Mission on Transformative Mobility and Battery Storage with its mission to formulate and launch a Phased Manufacturing Program with a focus on batteries including: raw materials, electrochemistry, end of life treatment (recycling), manufacture of cells, modules, battery packs usage in vehicles. India is also expected to be fourth largest electrical storage market.

“Li-ion batteries – Where we are now and what is the direction of travel?” by Alison Saxby, Director Operations,

“Li-ion batteries – Where we are now and what is the direction of travel?” by Alison Saxby, Director Operations,  “High purity quartz supply & demand” by Murray Lines, Managing Director,

“High purity quartz supply & demand” by Murray Lines, Managing Director,

Poddar gave an overview of African developments and commented on the high demand growth in multiple applications, such as Li-ion batteries, flame retardants, foil and thermal management, composites, recarburisers, fuel cells, lubrication, and graphene.

Poddar gave an overview of African developments and commented on the high demand growth in multiple applications, such as Li-ion batteries, flame retardants, foil and thermal management, composites, recarburisers, fuel cells, lubrication, and graphene.

Giving back to society has been one of Chetan Shah’s core tenets, and over the years his philanthropic zest through the Ashapura Foundation has touched thousands of lives through initiatives in water harvesting, education, vocational training, women’s empowerment, and social upliftment through the restoration and promotion of arts & crafts from Gujarat. This is none more so evident than at the spectacular Vande Mataram Memorial at Bhuj – a unique 4D non-profit national monument dedicated to India’s freedom struggle from the revolt of 1857 to the country’s Independence in 1947.

Giving back to society has been one of Chetan Shah’s core tenets, and over the years his philanthropic zest through the Ashapura Foundation has touched thousands of lives through initiatives in water harvesting, education, vocational training, women’s empowerment, and social upliftment through the restoration and promotion of arts & crafts from Gujarat. This is none more so evident than at the spectacular Vande Mataram Memorial at Bhuj – a unique 4D non-profit national monument dedicated to India’s freedom struggle from the revolt of 1857 to the country’s Independence in 1947.